The market, all markets hate you. Even you Bitcoin maximalist out there, the $BTC chart hates you (like everybody else it’s kind of sick of you talking about it all the time). Move on to ETH or LTC at least.

So what do we do about this whole market hatting us challenge?

One answer comes from what I’ve learned as I’ve polled members, so I’m creating the right training content for them.

I have blind spots because of assumptions (yeah, I know about the whole don’t assume cause your ass will explode saying… or whatever it is). I’ve been mentioning patterns quite a bit lately, and feedback from someone justified this:

“Noticed patterns on charts a long time ago, you never really mentioned (until recently) W, double top and so on. I thought they might be too mainstream for you”

That’s true. I assumed everybody knew patterns and just how important they are. We have an awesome system that tells us where to look on the chart, where to predict price movement, and where to predict reactions. A system that reverses engineers’ momentum and bias.

Ultimately once it does, you need to know what to do and to do it with conviction.

I teach patterns differently. While many patterns taught are good, even good to know, they lack context (they lack more, but I’ll stay focused).

Get This, and You Are in the 10%…

There are patterns that happen time and time again in the market on every timeframe.

These patterns are utterly useless by themselves. Read those patterns thru momentum and bias you have an edge. Momentum and bias tell you the story of the chart.

You might say… yeah, I get that, whatever, dude.

The difference between you knowing a “head and shoulders” pattern succeeding and knowing how to trade it with conviction is momentum and bias. Without it, your trade is 50/50.

With the guidance of momentum/bias, it’s higher, and at minimum, you’re out of that trade quicker.

Why trading is hard is because not every pattern works in every situation (but the pattern is there). Also, even the top patterns fail when everything aligns.

The market is messy, confusing, and hates you. It wants to take your money. It also loves to entice you.

What I teach is simplicity:

- We have a reaction area

- We look for the early development of a pattern(s).

It’s really simple from there:

- What should happen?

- What shouldn’t happen?

- We use indicators and rules to answer those questions.

That’s all we do. That is the only reason all those lines and stuff are on a chart.

You’ll be wrong; as I said, the market hates you. It’s annoyed you’re trying to take its money. So it’s not going to make it easy.

The market will try to do to you what happened to those guys in the first Hangover movie. It’s going to drug you and make you do some crazy stuff that you’ll think is a dream and won’t even remember.

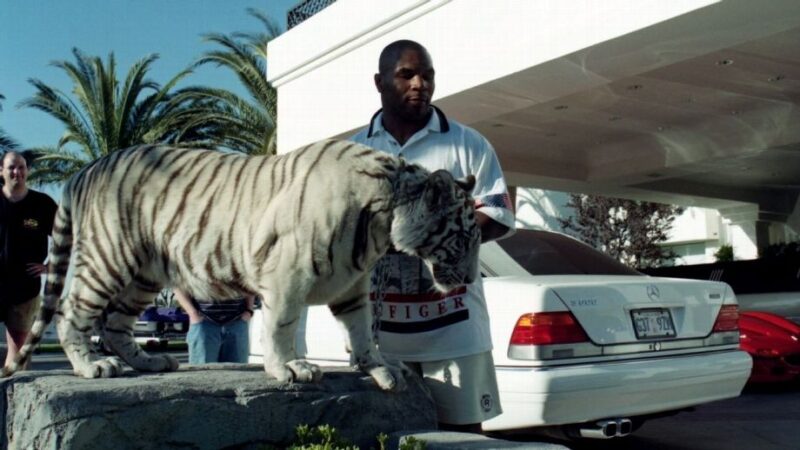

Except, well, tomorrow, you’ll wake up with Mike Tyson and a tiger :tiger2: in your bed :sleeping_accommodation: — I get it for some that might be a great morning.

For others, stay off the roofies and focus on consistently taking capital from the market.

You do that by knowing where to look and trading simple patterns. Use your indicators to reveal to you if they are succeeding or not.

Keep risk in line, and then, the market will accept you into its world.

I just love the timing of the this scene with the punch. Just perfect filmmaking: