One of common questions I get with from beginning traders is something along the lines of:

If I get into you’re training what is the minimum I need to trade with?

I’ve put together something ta step by step approach but first I’d like to ensure you are aware of the odds someone in this situation faces.

Also, I’m answering this question from someone who is interested in adopting and making my trading system their own and want to go through my training, get access to the exclusive indicators, and be part of the Trade Room Alpha, etc.

First, it can be done. But you must not ignore the odds and reality you face.

I routinely start small accounts. Recently I started a crypto futures account with $640. That account is now up to $5,700 in under 21 days.

That’s unrealistic to expect and was done by someone who has strong conviction in their system.

Also I have strong positive trading habits, only trade when in a positive mental state, and have 6+ years of trading. 6 Years in reality isn’t that long but when you’ve been profitable for 4 of those 6 you’re on the right side.

What’s the minimum capital?

There are 2 answers to this, the bare minimum and the minimum that is realistic. I’m not giving you financial advice. What I discuss below is trading futures or Forex, with a discount, but trusted and reliable broker.

The bare minimum that is realistic is between 4,000-5,000.

I know you can start an account and trade with as little as $300. The sheer amount of skill required to grow an account from that level and become an elite trader is not even worth discussing.

Sidebar: Most new traders are under-capitalized. They don’t have enough capital in their trading account to trade any system properly. Most new traders don’t realize this. It’s like trying drive your car with the emergency brake on.

Here’s your outlay and path:

- $997 – one time membership fee includes all training, everything, access to Trade Room Alpha, private indicators, private channels, and everything else I ever add.

- $3000+ to fund your trading account.

Path forward:

- 14-60+ days to go through the training material and fully grasped the system

- This will depend on how much market and trading experience you already have

- How well you learn and apply new skills or thinking

- Sometimes you have to unlearn bad/negative trading habits

- Also, now that I have Trade Room Alpha I’m re-enforcing basics and actively sharing my own trades– I’m finding that’s helping quite a bit on re-enforcing the foundation and basics.

IMPORTANT: There is an important milestone you must accomplish here. You have take my system and make it your own. You have to prove to yourself it’s as awesome as it is and build the conviction that there is edge there.

Even though you can watch me prove it day after day that will not build your own confidence and conviction to trade the system – here’s the secret… once you get to this point it’s no longer my system it is now inspired by me and your own trade system where you don’t need anyone one but yourself to at will pull capital from the market.

10 Green Days – After Training and Conviction

After you’ve completed the training and have internal conviction (some do this while they’re still going through the training):

- Paper trade in a demo account (with the same capital you have) for 10 straight trading sessions/days for (or 10 trading sessions)

- I use trading sessions because instead of saying 10 days you might have a few days between trading sessions given your life and schedule.

Here’s the catch…

- You will paper trade or demo trade until you have 10 straight green successful trading sessions.

Holy Schnikes you say! 10 straight green trading sessions! Did I read that right?

Yes.

I know this goes against what you hear from other traders, read in books, hear on Twitter, etc. Most traders self limit themselves to the opportunities the market presents.

Let me bottom line before I share how this is possible.

Before you even think about trading live capital (and if you only have a few thousand ) you need to be a a trader who trades with conviction. A trader who wields their trade system and edge with precision in mind, body and execution.

I’m not training lazy do nothing get hacked down in the first minute of combat coliseum fodder– I’m training gladiators — Elite Traders.

Why the hell would I trade a system that doesn’t win?

How These Results are Possible

If you look at the market and see on some days it goes up and some days it goes down why wouldn’t you create a system where you could try to figure out which way it’s going to go before it does?

Duh, sure, that’s what all traders are trying to do.

I don’t know what these other traders, gurus, furus, authors, et all are doing out there but I chalk it up to they aren’t as dedicated, obsessed, interested, passionate, inquisitive, and aggressive as I am about taking capital from the market no matter what time of the day it is.

I don’t say that from arrogance. If I didn’t do this– and if you’re in my Discord you see I prove it every day then I’d have no legs to stand on.

Something most don’t understand about my trading system.

It’s an always in trading system that reverse engineers’ momentum. If the market is moving in either direction I want to participate.

At any given time I am able to look at a chart and know what is the best probable long trade and what is the best probable short trade. It’s that simple.

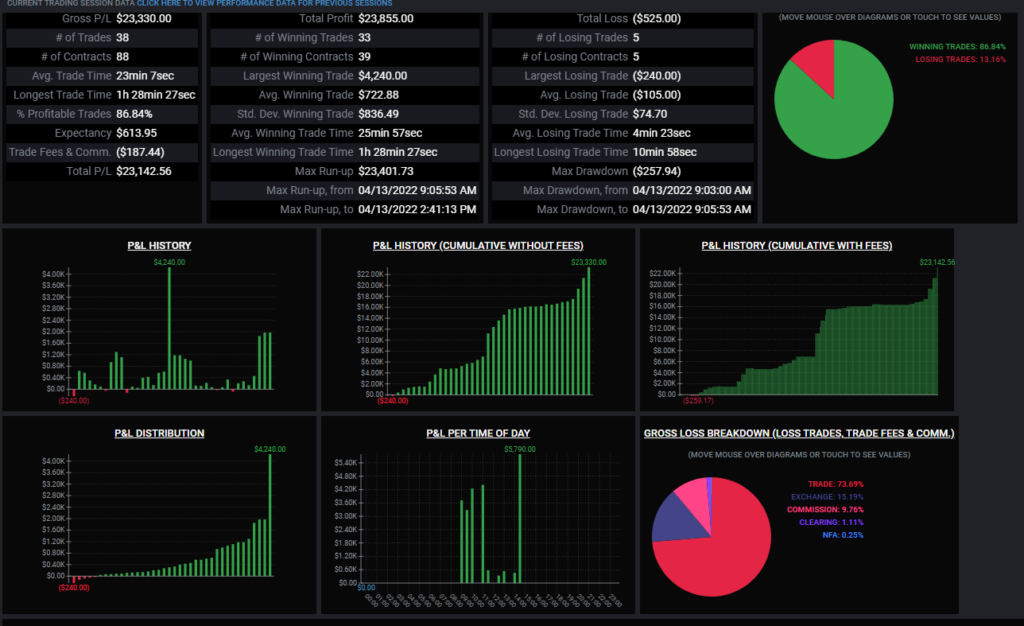

I don’t do this often– I am starting to now that I have the trading room but I don’t share my PnL simply because most people aren’t trading at my size. Here’s an recent example of a light trading day:

The system also provides you areas of high probability reaction areas on a chart. The system is good at defining both taking profits and entries.

Here’s the most important concept on reaction areas:

- Those areas are high probable areas but not guaranteed

- Each reaction is a self-contained reaction event that is unique to that moment in time and area in the chart

- There is no template reaction and there never will or can be

- Those that are looking for a simple template are seeking comfort

I believe one of the biggest hurdles new traders have is they self-sabotage their trading seeking to feel safe, secure, and comfortable.

You will never reach a point where trading is comfortable. If that happens you better be very careful because typically bad things are about to happen.

There are times when you’re very comfortable, but it only takes one trade to bring you back to reality.

Now that we covered some basics let’s move onto getting to actual trading a live account.

After 21 – Live Trading

Here’s where the rubber meets the road.

After you’ve successfully completed the 21-session trading goal you’re ready to jump into live trading.

Here’s the process for that:

- You should not change anything that has allowed you to accomplish the 21 trading sessions

- If you’re first session of trading real capital, you break even or have a red day you stop

What you’ve identified is you have a mental block or a psychological trading issue.

Adding real capital has shown you are not ready. There is something inside of your mind, thinking or trading habits that is off.

You need to figure out what this is and deal with it.

Steps to Deal with Real Capital Failure

- Go back to paper/demo trading for at least 3 trading sessions.

- Figure out what mental mistakes you’re making

- Don’t go back to live account until you have 3 straight green trading sessions

That’s it.

It’s that simple— it’s not easy, simple yes, easy no.

If you don’t have the discipline to do what I’ve outlined then maybe you don’t have what it takes to trade successfully.

Going Forward from There

It’s hard to provide guidance from this point because as you continue to trade and grow, you’ll have various hurdles and roadblocks you will have to break thru.

Generally, though it comes down to if you have a negative day you take a step back and look at what decisions you made and the overall trading session to find places where your negative trading habits made an impact.