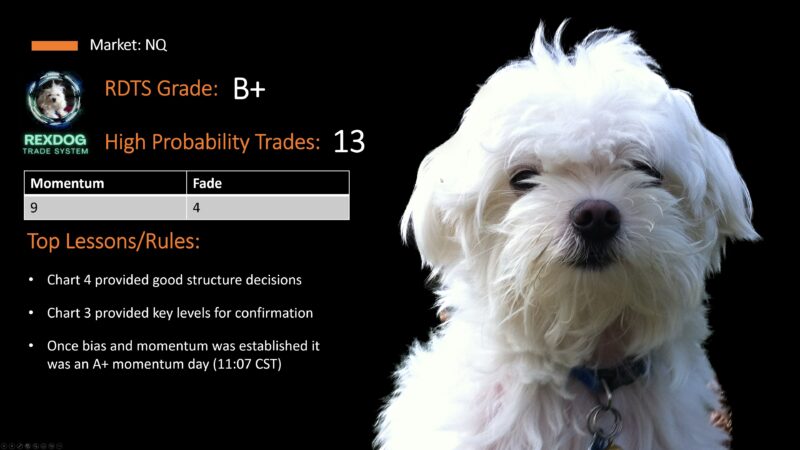

One of the most effective things you can do at the end of a trading session or day is grade your trade system.

This isn’t how you traded the system this is how well the trade system did with providing you high probability trades.

More importantly, always understanding your systems RISK PROFILE.

In this article, I’ll go into detail how we arrive at grading a chart, the benefits, limitations, and how these grades help those adopting the RDTS.

Footnote: I actually wrote every word of this… I did not consult the manic semi sentient ChatGPT.

We grade the RDTS in the following manner:

Overview of Grade

We use the standard alphabetical old school A-F grading system with the addition of a (+/-).

There are no participation grades with the RDTS.

- A = the trade system aligned perfectly with the market directional bias and momentum and provided clear high probability trades

- B = the trade system aligned well with price action but there were areas where no clear signal or edge

- C = While still profitable, the system didn’t provide clear and concise edge

- D = The pendulum has swung, and the system put you on the wrong side of the market more than the right side

- F = The system utterly failed

Reality of These Grades

Since creating the RexDog Trade System (RDTS) I’ve never experienced or had an F grade day.

Not that there haven’t been extremely hard days to trade, but rarely are you wildly out of sync with the market even in high volatility days, especially if you’re using the 4-chart setup.

Why?

The system is an always in momentum following system. This is critical:

Most trade systems fail because they do not know how to properly define momentum. Momentum is a multi-time frame beast. Here’s the key to increase your edge when trading momentum. Take time out as a factor.

You’re fortunate because you trade a system reverse engineer’s momentum. You use the 4-chart setup (or a derivative if no tick charts) you have a system that properly tracks BIAS and MOMENTUM.

Benefits of the Grade

We focus the grade from a day trading perspective. This is most helpful for traders either a scalping or swing trading intraday.

Intraday trading involves trading securities in a single day only during the market’s regular business hours. Interday trading is when a trader purchases securities with the expectation that it may take longer than a day to reach the profit goal.

We could grade any chart (ticker), any market, on any timeframe. It does not require the 4-chart setup and there is no market, ticker, timeframe that the RDTS does not provide edge. Prove me wrong, send me a chart.

You should compare the grade and the best trade setups provided with how you are adopting the RDTS. You should do this anyway for your own benefit. I’ll share at the end of this article some bonuses benefits that come from capturing this data over the long term.

How the Grade is Created

Here is what factors into how we create the grade:

- How well did RD BIAS rules hold up and for how long?

- How well did the RD MOMENTUM rules hold up for how long?

- How well did the high probability patterns perform?

- How well did the low probability patterns perform?

- How well did the confirmation patterns perform?

How discretionary are these questions?

There will always be an element of “art” and “market experience” involved in executing trading with the RDTS and psychology and mindset are critical to successful trading.

Art, market experience, mindset, and psychology play zero role in how well the system performs.

On an A day, your ability to read and trade the market should be much easier than a C- day, but that isn’t the full story. These grades assume the trader…

Trades the system with conviction, trust the charts, and can effectively manage their emotions to trade. Yes, I said use your emotions, not trade like a robot, which is impossible for any emotional based being.

The grade is not how easy it is to trade the system that day– the grade is how well the rules, patterns, and RISK PROFILE performed.

Risk Profile

This revelation is something I haven’t precisely stated. Have you ever wondered why you don’t see or hear me constantly rail about risk, stop losses, and even asinine concepts like Risk/Reward Ratio?

Here’s why…

Risk and specifically limited risk is baked into the RexDog Trade System.

This is so underappreciated because I can almost guarantee most of those that are reading or hearing this haven’t fully evaluated other trading systems or trading styles to the extent I have.

For example, I bet most people take indicators like the MACD or RSI at face value. Sure, you might have looked at a few other derivatives or custom takes on the indicator, but I bet very few have systematically taken apart those indicators. I have.

That means using it in the way it’s taught, then doing the exact opposite. Then going even further and going down the rabbit hole of custom values and a combination of custom values.

I’m not trying to appear arrogant or highlight that I’m special (I am, at least that’s what Moms always told me, and Dad did before that one time he didn’t come back from getting cigarettes).

I’m providing context to why I don’t consistently harp on risk and risk management.

The RDTS at its core is about revealing to you on chart where to look for high probability reaction areas.

These areas either go in our expected direction or they don’t in a relatively quick amount of time.

Your attention is focused on the exact areas/zones of a chart where trades either work or they don’t.

The power of the indicators, rules, and patterns we use in the RDTS tell you to take trades where your risk is minimal. You are not trading in high-risk areas; you are trading on what 80% of the time are reliable zones. At a minimum, the trade almost always moves in your expected direction before or if it fails.

That’s why when you trade the system on almost every defined reaction area or zone you see a reaction.

You Won’t See This Any Other Trading Site…

I get it, most won’t appreciate how truly unique what I just shared is in the world of trading. If you don’t and I’m not saying this for my praise or to hype up the system but take time to reflect on what I’ve just shared.

Other trade systems talk a good game, but they almost all cannot be traded effectively beyond their creators because most other trade systems look for trades in arbitrary areas.

Here’s the kicker— because at their core these trades systems allow trades in these arbitrary zones every trade these systems provide are always 50/50.

If you haven’t realized this yet, let me be very clear. I’m not trying to convince you. I already benefit from the trade system I developed. Now that I stream so much, I prove that every day.

Not to get off topic but I’ll address a few things because it will parallel with this article.

You’ve Self Selected…

You might wonder why I don’t have testimonials from other traders and ALPHA members who trade the RDTS.

I most likely never will, not because I couldn’t get them. It’s because 99% of testimonials you see of this ilk are BS.

They don’t represent if you can or will trade the system successfully. That testimonial has zero bearing on what is an individualistic approach to adopting the system you are being presented.

It’s simply there to make you feel all warm and fuzzy. It’s there to psychologically deal with a valid objection you have when considering buying into the system.

I don’t want you to be warm and fuzzy. I want you to join still having objections. The only people I want to join my training, become a member and adopt my trade system are those who don’t need these false sales techniques.

Why? Those others are predisposed to those techniques and they have a very limited chance of actually taking the very special system I’ve developed and successfully trading with it.

I don’t want to deal with them and their issues.

If I can be even more blunt. Those people have mental blocks that fester self-limiting beliefs and they lack the ability to take the RDTS and make it their own. I believe anybody can be a successful trader— with these caveats. Becoming a successful trader requires grit and the ability to confidently walk your own path.

Yes, you might have various guides along the way. Those that provide a meal here and there, or to use this analogy, someone like me that provides you with a detailed map. In the end you have to accomplish this journey alone.

If on that map there is supposed to be tree but because of a recent storm it is no longer there, the people who adopt my system know how to still find their way. Sure, they might have to analyze the terrain and find other landmarks, but ultimately they will get to the destination.

Those others, they will turn around and ultimately die in the wilderness because they’ll get lost focused on trying to get back so they can tell me they couldn’t find the tree.

Grading Rotting Corpses

That’s really what we’re doing. In hindsight, any YouTube trader can look like an utter genius. Any brilliant social media first trader can trade 2 or more simultaneous accounts and just show the ones that profit. They just adopt the tried-and-true technique mastered by the sport betting gurus that rise and falls to fame like the ocean tide.

But there is something more at play here. The elements of the RDTS are not like the myths of every 7th, 9th, or 13th wave. Consider this…

How many times have you seen on a chart where price reacts almost perfectly reacts at the RDA (RexDog Average)?

The only valid answer is it’s rather common. Almost too good to believe. To answer otherwise means you haven’t really done the analysis yourself.

I say this confidently because we can pull up any chart from any market on any timeframe and we will see a consistent pattern with the RDA. It provides a solid basis for BIAS both short and long as well as consistently confirms the momentum direction and acts as strong reaction area.

Often, price stops at the RDA in an area that makes no sense otherwise, at least not from any well-known form of technical analysis that exists.

This same axiom holds true at varying degrees for the other indicators, rules, and patterns we use in the RDTS.

This leads us to the real value and benefit of taking the time and effort to create these grades.

Isn’t a Diploma Just a Fancy Piece of Paper?

Sure, but it’s the value others place in what the diploma represents. It’s how you leverage the diploma that really matters.

The grade we provide has value in the following way:

- As objectively as possible, asses the trade system on a consistent basis

- Provides insight so the trade system can be consistently improved

- re-enforces the fundamentals of trading the system as it’s designed

- Provides you with additional examples of how to use the indicators, rules, and patterns provide edge

- Allows us to capture a consistent database of stats that is more valuable than any backrest method that exists

Successful trading any system is about trading with conviction and risk management. As discussed above, risk management (at least a good portion is accounted for in every element of the system).

Conviction, that’s the tricky part. Conviction is only built by belief. Belief is only built by trust. Trust is only built by consistency.

By following the grades, you are adding one more element of consistency you see play out time and time again when adopting the RDTS. That consistency is a pattern. The more you see and consume charts graded with the RDTS the more you’ll be able to recognize and trade them as they unfold in real time.

I’ll relate it to what we discussed about the RDA. For most people who adopt the system and see how time and time again price reacts at the RDA you just start to trust it. You start to trade around it and with it. Why?

Because it’s a pattern you see unfold time and time again. So when you get an opportunity to trade it in real time you trade it with conviction.

Does it always work? No, of course not. But it works way more than it doesn’t. Plus, if you mange your trade correctly you’ve either made a little bit of profit, broke even, or minimized your loss because by it’s very nature your trading in area where risk is tightly defined.

I’ll end with this…

These grades are provided that help your mind identify patterns in the market. They are a tool, a tool that takes a series of interrelated data points and distills it down to one base value. Just like how the 4-Chart setup cascades down on confirmation the grade will cascade down into your subconscious so you can call upon it when a similar or like pattern unfolds in the future.