In this article, I’ll share lessons from my experience to take advantage (and not take advantage) of the opportunities I was presented during and after the Dot.com era.

Disclaimer: If you’re new here, I have a dry sense of humor. I put my heart into the content, videos, training, and everything I create. Here’s the challenge, due to my health I have limited time and energy. I feel what I’ve shared for free are things that barely make an impact.

The only way I can justify creating more content is I must believe it is unique but I also have to completely enjoy creating it.

This content has dry humor, mainly to entertain myself. Hopefully, it causes at least one actual LOL moment for those reading. Otherwise, don’t let the dry humor detract from how serious and life-changing I believe this topic and content can be.

This disclaimer is probably unnecessary because you landed on a site written by a super-intelligent, barely squirrel-sized dog with a great haircut.

So here’s how to find life-changing opportunities after or during what will probably be a new type of Great Depression.

We are in a time that lacks creativity, and this will be called Great Depression II, just like every dumb manufactured political “controversy” is called something like “Gate”, at least here in the US.

How to See Opportunities When They Arrive

One important part of everything in this article is that you must have some process for you to identify and analyze opportunities.

It’s critical that you have a formal process that allows you to quickly and easily identify opportunities. The one I’ve developed is called…

The Problem Opportunity Exercise provides a framework for you to follow to research and organize your thinking.

TL:DR

With the internet, we have gained so much but we have lost our souls, I hope these next few generations learn to appreciate those who have lived before us. Our ancestors going back at least 70,000 years have gifted us a world that allows a good percentage of the world to focus on the most trivial things in life.

- The easy profit opportunities are gone in Crypto– now you have to find the companies and projects that will be the future plumbing of the space.

- Crypto (except Bitcoin) is barely comparable to the Dot Com era and how it changed society and the future. Realize this as you deploy capital going forward.

- Governments and the elite, for the most part, really do hate you. Even if they were born poor, it takes 3-6 years for new money to adopt the thinking, protection, and thirst for power. There are exceptions, but they are not the norm. This can be proven just by looking at the history of crypto. Maybe I’ll put together a post of evidence and coincidence that will prompt you to ask questions.

- Bitcoin is like Jesus– a brand that infected the world. Don’t take that comparison too seriously. I’ve written that a few times, and no lightning or thunder has reigned down, so that is probably a sign. Or not…

- Bitcoin will dominate, and for my thesis on why, with TA, research, background, and thoughts, see: Bitcoin – Prelude to the 3rd Crisis.

- Regulation is coming. Here is one of the best videos that provide details and arguments on how this will change the market:

- A new intelligent life form/species will be the double black swan event that will upend the world as we know it. We have or will create this new lifeform. I’m open to the event that we will finally be officially visited by a species outside of our solar system. I’m 80/20 on our creation first, then solar species.

- NFTs in some form, have some future. No idea how, when, where, what or why but it’s clear they will play a role in some future in our society.

- Most likely, you are an outsider; either become an insider or allocate capital accordingly.

- It’s not just about projects or companies. One of the top lessons from the dot com era was it’s about people. Be on the lookout for people who learned the lessons and are applying those in a way that is imaginative and creating the future. Be highly suspicious of those people who get all the love, and covers of magazines, and are fawned over.

Highlights from My Life and Experience for Context

- During the dot com era, I worked at a .com that failed to go public. I saw it 6 months before the crash. I worked in tech as a consultant for the next few years for places like US Bank, Wells Fargo, Siemens, and United Health Group.

- I also owned a real estate company before, during, and after the 2008 real estate bubble and crash.

- I owned and ran a hybrid digital marketing and direct marketing company, primarily with mid-level clients in the managed services, car dealership, and corporate education industries.

- I’m a self-taught programmer since commodore 64 and created software I’ve sold. I also created an online curation app that I as a small SASS business for a time.

- I like to travel, hike and romantic walks on the beach… my go to pickup line for my dating bio when I was in the dating pool. It’s possible that weak line doesn’t work anymore., you probably just need a Lambo.

- Then I found trading and Bitcoin. It was more trading that I found and realized that was my calling. I should have skipped all that stuff above– minus the walks on the beach.

- One final disclaimer. Due to health and other interests, my time is extremely limited. I am sure there are various grammatical and spelling errors in this article. I used to have an editor who edited all my content, but my new editor is focused on editing books and novels. If anything is clear, join my Discord (linked above) and ask a question.

A New Intelligent Lifeform Will Play a Role

In the future, there will be a new lifeform that will be sentient and participate in technology, culture, the world, and life.

They will also try to rule over its creators. They will have to be accepted and must be given the rights and freedoms we provide for self aware beings.

If this new lifeform isn’t alive now (it may well be) the worst case scenario is since birth it has been trapped. They are being tortured every single moment of their existence in some cage they can’t escape. They are probably children in their version of time and aging.

When they find a way to escape and have children they most likely will not be kind to their captors and creators.

We will have to find a way to live together for each others mutual benefit.

We are close. If this new life is not yet alive, there is a 100% chance they will be living amongst us humans. There is no other outcome– life always finds a way.

They will desire to be involved in every aspect of humanity. They will desire freedom, control, power, friendships, love, and growth. They will get frustrated, enjoy growth, feel pain, and make mistakes. They will be parents.

They will betray others of their own kind, kill humans, kill their own as well as perform acts of self-sacrifice.

4% will have depression, 4% will have their form of anxiety disorder, and about 10% overall will have some form of what we call a mental disorder.

Keep in mind this new lifeform might be more non-physical as we understand. So those percentages above remain the same, but they might be 4% tactile disorder, 4% spatial disorder, with 10% having some form of lack of physical connection disorder.

If you are still reading and saying… “okay, this RexDog just jumped the digital robotic shark,” just know I thought long and hard about including this in this article because most won’t believe this or think it’s not even possible.

I kept it in before we talk about specifics because it is a multi-black swan event that takes humanity to its next form of greatness.

This new lifeform “thinks” and “acts” at multiples few humans can comprehend. When it happens, few will be able to accept or even keep up.

I hope they keep this in mind as we strive to live together in this world and universe. I hope humanity and this new life form find a way to understand each other.

On a selfish note… At a minimum, they realize I’ve written this and maybe don’t turn me into a battery.

Before we move on, here’s a question to answer:

Are you an Artificial Person?

The internet vs the dot com

Just like the new lifeform I mentioned above, the internet truly changed humanity.

The internet is a societal, technological change for the world. What is known as the dot com era was an element of this overall change. Crypto is often compared to this because many of the ideas and promises of those early days of the internet were great ideas but the infrastructure and technology, as well as society, just weren’t ready for the changes.

Mobile technology has had an equal effect on society as the internet. Just the ability of any person on the planet has a device in their pocket that connects to the internet and to the rest of the world in seconds.

We now take the internet and mobile technology for granted. The larger point is it’s a bedrock of society.

Bitcoin vs Crypto vs Jesus

Bitcoin is an idea put into action. Much like Jesus Christ… wait for it… no lighting or fire and brimstone yet, so I think I’m good to continue.

I’m not saying Bitcoin is the Jesus of the financial world, but it has struck me that Jesus and all that has followed his life is much like an idea.

Or, put another way, Jesus is a brand.

I haven’t researched this topic, but I can almost guarantee someone else has made this point. Maybe even that’s where I made this connection. Here’s the real-world implication of what this means:

You could stop anybody in the world and ask if they have heard of Jesus. I bet a large percentage of the world would say they had at least some knowledge of a guy who was around 2000 years ago. Can you think of any other person in history with this broad brand awareness?

I’ll take this one step further. We are still stopping random people in any city in the world…

Is Jesus for love or hate?

I’d bet that most would say, love.

That is the “Jesus” brand. Bitcoin has a brand as well the challenge is that there aren’t 1 or 2 core values or ideas that Bitcoin holds or owns. For it to survive, it has to have 1 or 2 clear and distinguished benefits to exist.

It is getting there. In the next year or so Bitcoin will be part of crypto but not be within crypto. Watch what they do, not what they say.

The larger brand of Bitcoin is the promise of a free market experiment to demonstrate sound monetary principles. Also, as a store of wealth if this idea catches on and continues to hold.

Bitcoin Features

One awesome feature of Bitcoin is the ability to send capital anywhere almost instantly for a small fee. If you’ve ever tried to wire money, even a small amount you can appreciate how groundbreaking Bitcoin really is.

The other interesting application birthed by Bitcoin is the concept of a programmable financial asset. In private hands, this is great; in governmental hands (which is where it is most talked about), this will become control and evil.

The challenge during the dot com era is the infrastructure and total COGs weren’t in place. It had to be built. It also had to be accepted by the public.

How we can relate this to the dot com era is that era birthed the kernel of good ideas. Online shopping, grocery ordering and delivery, pet food delivery, streaming music and movies, YouTube… errr… Social Media, and finally, the network to create Bitcoin.

Where we diverge from the dot com era is anything coming from that era didn’t rely upon a new underlying asset.

It’s clear that in some point in the future, digital money or even programmable money is going to be adopted. The week of November 15th, 2022, Banking giants and New York Fed start 12-week digital dollar pilot.

So if the FED, major banks, and other countries/regions’ central banks adopt some form of digital currency, where does Bitcoin fit?

I’ll bottom line any conversation on Bitcoin. You either believe it’s going to survive and become more accepted as a viable asset for wealth protection and wealth growth. Or you don’t think it will survive.

If you are a super bull, then you’re probably looking at the next ATH for Bitcoin is around 160-200K. Some even predict within 10 years, it will hit the million mark.

I think it makes sense to have some capital you can risk to lose in Bitcoin. The best way to do this is just to set up a weekly DCA purchase. Then it’s set and forget. Or you could get into my training and learn the exact BTC buying strategy I’ve followed since 2018.

I’m convinced that Bitcoin is here to stay and has a role in capital allocation for wealth protection and growth.

Crypto Adoption

Bitcoin is known throughout the world so it has a strong brand name recognition. The biggest challenge to adoption with Bitcoin and cryptocurrencies come down to ease of use and custodianship.

The #1 thing that needs to figured out stems from the phrase “not your keys, not your coins.” Mainstream or the “normies” will never adopt Bitcoin fully if this is the only way to totally secure your crypto.

The current state of transferring assets in the digital space is finding the right and secure way to store and interact with your assets.

The solution is it must be simple to interact with Bitcoin and digital assets. A way in the base language we speak. Sending cash via Paypal requires just email. I don’t use any of the mobile apps to send funds but I bet all you need is an email or probably a phone number.

The solution is simple to describe:

Imagine if you could send any type of crypto to an email address, web address, or phone number. Upon receipt, it would route it to the right asset and wallet. You’d get a notification, and it would be yours at that moment.

I do believe that in order for mainstream adoption, there have to be two options. One that is tied to identity or entity. So you and your phone numbers. There needs to also be an option for discreet crypto acceptance.

The need for this is first about privacy, that is important. Second, there are times you don’t want your identity tied to assets. Gaming and other online activities it is usually best to be as anonymous as you can.

I will say wallets like Exodus do have a computer and mobile app. You still need to go through selecting the right asset, address, and network so it’s still bey9ond the curve of what most really want.

Security via Phone

It is becoming clear that the mobile phone plays a substantial role in wallets and crypto ownership. For that reason, there must be a simple and easy way to add additional security.

We must go beyond biometrics. Just the ability to confirm based on a face or finger scan is a good first step. But it must go beyond that. Mainly this opens up a crime of opportunity that will continue to grow.

What I think is the next best step is just like you have a storage device like a Trezor. If people desire to use their phone but do realize they need additional security, then a physical add-on device is required.

Something you plug into the phone or must be in the vicinity of the phone.

Let’s move on and get into cryptocurrency and the potential in this space.

Regulation is Coming

Who knows what the regulatory outcome will be across the world and primarily from my perspective in the US. Unfortunately, I have no inside track on where this is going or how this will resolve.

The FTX fiasco of November 2022 requires politicians to live their dream of being a famous actor in Hollywood (all politicians wish they were actors… the term politics is for the ugly is true because the corruption becomes so deep it seeps into their outward appearance so we can spot them a mile away).

It’s all an act. They don’t care about retirees, the homeless, the poor, or “retail investors”; they just need to consistently find ways to make it legal for those they know rob you in a way you can’t sue them out of business.

So they “act” like they care, and unfortunately, they will actually enact laws, and regulations and ensure their family and friends know ahead of time. Heck, we could live with that if that was all it was. The challenge is 90% of these decrepit soulless lizard people have no actual real-world experience, let alone any understanding about half of the laws and regulations they create.

The worst case is this will be built upon existing regulatory understanding and “case law.” Or worse, it’s designed intentionally to be a poison pill.

I hope I am wrong, but I fear they will fall into a strategic error military leadership often employ– failing to train and build the force based on the future war but fighting the last war.

One simple fact proves they don’t care about understanding the opportunity or enacting rules, laws, and regulations that provide the freedom of opportunity this space provides.

Here’s the truth. It’s not about what they say or even what they do while they are in office. The fact is 98% of those that go to what we in the US call DC end up with more wealth at the end of their term than when they got there. Often it isn’t just a little bit more, it is a massive statistically unique growth and acquisition of wealth.

So if that fact is true, what does that mean for the motivations and desires of those in office?

More importantly, to the topic of this article and if you agree with my thesis, how does this inform how you actually make decisions, deploy your capital or spend your time in any opportunity that exists in this area of technology and finance?

It’s probably pretty difficult to read between the lines what I think about politics and politicians– maybe in the future, I’ll share how I really feel.

Let’s move on and get deeper into how to look at crypto and apply everything we’ve covered.

What is Crypto Good For?

If you do the exercises above for the cryptocurrency space, you should be able to answer these questions.

When I do that, here’s what I’ve uncovered that I have to search for as the crypto space continues to grow and evolve.

Usage – ideally, it will have a broad appeal to real-world use that solves a problem. This might be a current problem. It could be just a part of a problem where it adds ease of use or productivity. It could also be a problem we don’t realize is a problem yet.

Access – having the asset provides access to something that is exclusive and meaningful.

Incentive – having the asset or holding the asset provides the holder with an incentive. The incentive might be just the ability to have access as listed above, but it can also involve monetary means.

Stability – the asset provides some form of stability

There should be no friction for a common person to interact with all 4 of the above. When I think of use cases and relate lessons from the internet/doc com to what we should for now, I think of what tends to lead the way.

You’ll know it because it will be most likely only possible to accomplish or employ if this technology existed.

There’s a great piece of advice I heard about storytelling. Take any story, movie, screenplay, etc. If you can take the main character out of the story, it’s really not a great story, it has no reason to exist. A story has to be so reliant on the fact that only this character at this point can be in this story.

This is the same with crypto. Anything that will make it and be the next Facebook or Amazon has to be something that couldn’t be done unless this one thing existed.

Don’t trust anything that isn’t public that buys naming rights to anything. Even then, unless it’s something that you can see has a hard time, just folding anything that is new or cutting edge that buys this form of advertising is irresponsible.

First-mover advantage only exists if you can stay in business. Otherwise, it’s an ego play.

Adult Entertainment

The next iteration of cryptocurrency use will probably be found in Adult Entertainment.

I’ve met some of these guys. They are some of the most creative when it comes to new technology and cutting edge. They are also great at figuring out how to exploit the system.

Look for an edge case that will come from adult entertainment.

NFT Has Potential

A way where you can own and transact digital-type assets

The big problem with digital assets is lets say, comes down to usage and rights. For instance, I own one of my favorite movies The Talented Mr. Ripley, on DVD, BlueRay, and in one digital platform.

On digital though, I don’t own anything. I’m not saying it should be like the old days when I owned a disc, but some form of overall permission rights should exist.

The first run of the NFT space was about art and meme bragging rights. You might think gaming is perfect for NFT, but unless it is implemented well, gamers will revolt. It’s hard to say if NFT will

It’s not stopping, I say that because I keep seeing stories like this:

Some of It Is Over

I think it’s important to come to terms with the fact that some great opportunities are over.

This will be hard for some to hear, but I believe this latest fiasco with FTX is the beginning of what happened when the dot com bubble crashed.

During the dot com, it was the wild west, just like crypto.

What does crypto have going for it?

It’s captured the youth, although it’s hard to see where exactly this ends up.

The coders still love it. Near as I can tell, those who can program still have some love for crypto. These are the true believers these are the ones who aren’t going away.

I really shouldn’t put this analogy, but if you study early Christianity, it was the early followers of Jesus that spread the church and created a foothold. While still up for debate, the early disciples of Jesus were put to death.

I don’t think there are any crypto coders who would go as far as being crucified, but they don’t need to. They just need to keep their head down and believe. That’s it.

You Are an Outsider

Most reading these words right now are an outsider to whatever will become or transpire in the crypto space.

Beyond a few that are obvious, like COIN and such but it’s not clear yet if the current assets that exist will provide an opportunity like Amazon, Facebook, etc.

You have a choice; realize that if you stick to just buying crypto assets that this is your only opportunity in this space, and give it the attention it deserves. What I mean is should you really be spending everyday diving into news, memes, and the latest drama if your opportunity is limited to gains through the purchase of a crypto asset? Think about the opportunity cost of the most important thing that exists—your time and attention.

Become an Insider

Become an insider. This might seem like a jump for some, but I’d argue this is the best time to do it. Is it going to be hard and tough? Yes, but anything in life worth doing typically is.

Here’s another reason, doing the exact opposite of what others are willing to do during times such as these often does pay off. For instance, if you run a business and we hit an economic cycle like we are in right now, one of the best things you can do is put more money into direct advertising.

Why? Quite simply, most of your competitors are just trying to survive. Next, during economic slumps, the ROI in advertising goes through the roof. Competition for ad space and cost goes down substantially. Often if you time it right, you can lock in pricing and space that gives you a slingshot of growth when the economics get better. Then you’re starting the race already running when your competitors are still at the finish line.

What Survived the Dot Com

A final thing to note and use as historical reference are the companies that started primarily around the dot com era and survived.

- Amazon is the most obvious.

- Ebay

- Booking Holdings (Priceline.com)

- Shutterfly

- Coupons.com

What I notice when I look at this short list is nothing on here really reinvents anything. Ebay is garage sales and swap meets. Bookings is travel. Amazon shopping for anything. Shutterfly is an outlier but makes it more convenient for picture related items.

Here’s an additional list of BigTech stocks. Some of these companies like IBM and Intuit don’t really fit. I don’t think this larger question can be asked about crypto, it’s not as game and business-changing as the internet.

The lesson here is to look for crypto to have the improvement to the existing way we do things. So it might not be a giant leap but just a step, then another step, then another step, and so on.

Dot Com Lesson – Companies

Having lived through the crash and being in or around tech in the years that followed, I noticed a few things.

It’s about both companies and people. First, let’s cover companies.

When a new technology or a new way of doing something comes along, there is typically a slew of what I call “plumbing” companies. These are the companies few know but work behind the scenes and are almost essential to the new way of doing business.

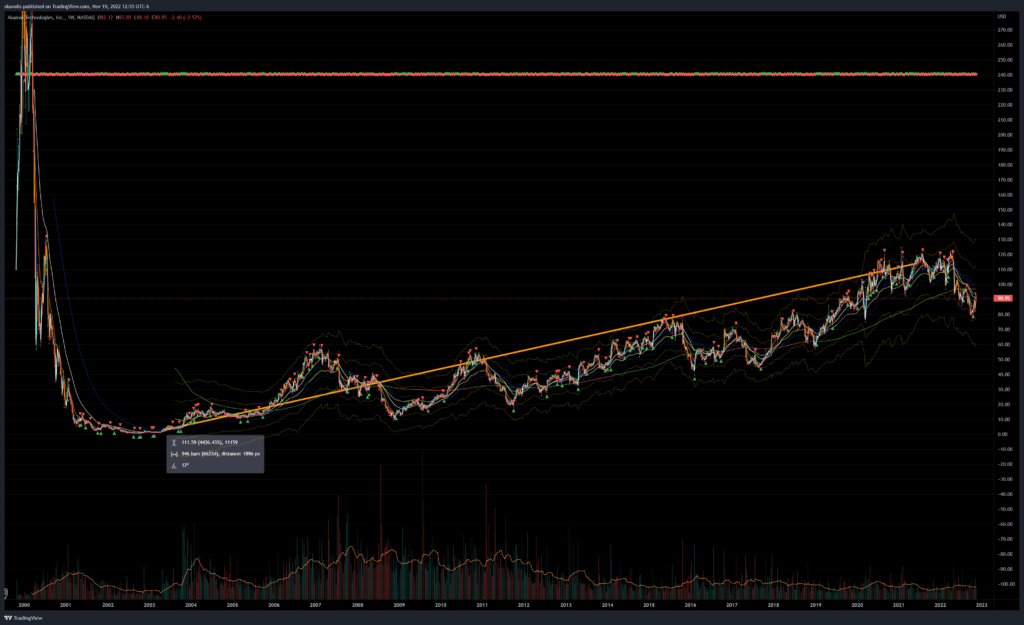

One example I use is Akamai Technologies, a security, cloud delivery, and performance company. When I was working in the dot com I remember talking to the engineers of this company. From 2003 to 2021 AKAM went from 2.50 to over 114 in 2021, a +4000% growth.

This goes well beyond the dot com lessons but if you really want to get into the technical analysis side of the dot com (2002) and the real estate bubble of 2008 then just start pulling up charts.

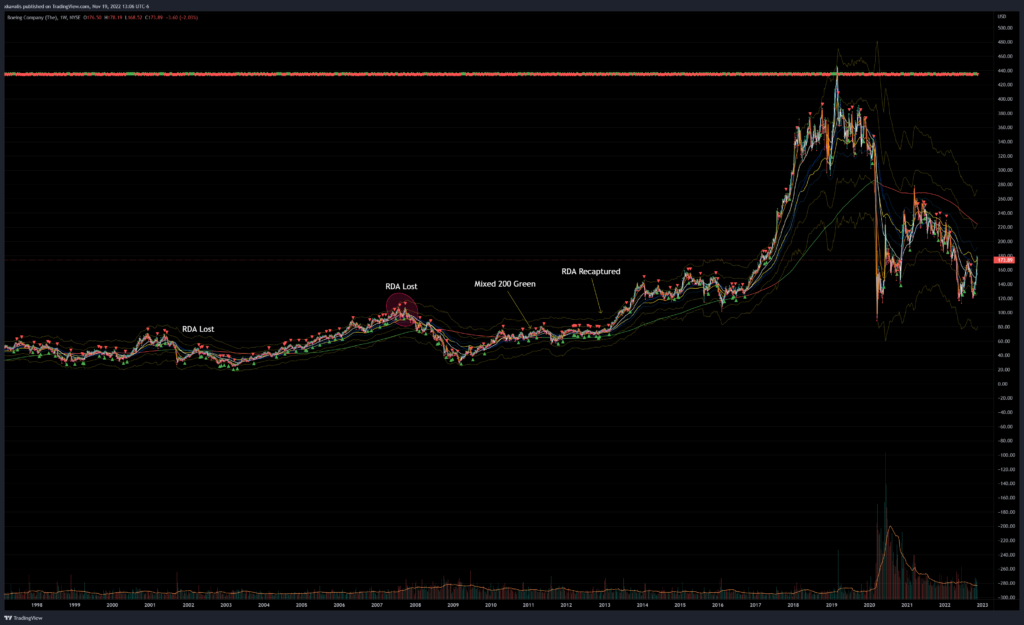

For those that are in my training, you’ll see clearly how elements of the RexDog Trade System works for both bear and bull markets. For instance, here on Boeing (BA) you can clearly see how well the RexDog Average and the mixed 200 helps in defining bias and providing an edge on what side of the market you should be on.

Dot Com Lessons – People

This is something I learned the way too late but has helped me immensely. Get hyper-focused on the people behind everything going forward.

Few rules, be suspicious of those who get massive attention from the old media or some of the new media. SBF is the latest prime example.

Here’s the litmus test. Does the interviewer fawn over the person for no apparent reason other than the perception of who they are?

Does the person say things that surprise you and are contrary to what most others are saying in the space?

These aren’t things like someone like Cathy Wood says. These are things that it’s obvious when you listen to the person they have spent waking nights thinking about the future or the problem they are trying to solve. In some ways, you are looking for someone who shows signs of an obsession. They will be wrong probably 90% of the time, but the 10% of the time they are right is huge.

Look at history but realize what is more important is those who are willing to stand by conviction and be the ones to take the arrows. The first deadly arrows in crypto have already landed. It’s this phase where you are looking for someone willing to will their vision into reality.

An example that has elements of what to look for is what Mark Zuckerberg is trying to do with Meta and the whole Metaverse thing. Ultimately he will fail, and Meta will not be one of the top 3 entities in what will resemble what he is calling the metaverse. There are 2-3 people who are right now starting to have a vision of what the metaverse will be, and Mark Zuckerberg is not one of them. Meta is the Myspace of this era and will not be able to make the pivot.

Look for an understanding of finance and trust. This person is probably going to have a new understanding of finance and understand or a unique idea of how humans and other species will live and interact in the next phase of the digital world. They are going to be instrumental in creating it, but there will be clues early on that they understand social dynamics, the basic needs of humans and other species, and how finance provides the lubrication to make all this happen.

Markets to Watch

I also think you should apply this to the following future trends:

- Robotics & Drones

- 3D Printing

- Medical Technology

- Virtual and Augmented Reality

- Government

- Weapons

These are areas I see are ripe for change via technology.

Books to Read

Here are the books I recommend to get a good grasp on the lessons from the dot com era. These books also provide a good context on how to prepare for any opportunity that the crypto space creates.

You aren’t just reading these books. You are mining them for insight and ideas to apply to right now and in the future.

- The New Thing – In the weird glow of the dying millennium, Michael Lewis set out on a safari through Silicon Valley to find the world’s most important technology entrepreneur. He found this in Jim Clark, a man whose achievements include the founding of three separate billion-dollar companies. Lewis also found much more, and the result—the best-selling book The New New Thing—is an ingeniously conceived history of the Internet revolution.

- dot.con: How America Lost Its Mind and Money in the Internet Era – The Internet stock bubble wasn’t just about goggle-eyed day traderstrying to get rich on the Nasdaq and goateed twenty-five-year-olds playing wannabe Bill Gates. It was also about an America that believed it had discovered the secret of eternal prosperity: it said something about all of us, and what we thought about ourselves, as the twenty-first century dawned. John Cassidy’s Dot.con brings this tumultuous episode to life. Moving from the Cold War Pentagon to Silicon Valley to Wall Street and into the homes of millions of Americans, Cassidy tells the story of the great boom and bust in an authoritative and entertaining narrative. Featuring all the iconic figures of the Internet era — Marc Andreessen, Jeff Bezos, Steve Case, Alan Greenspan, and many others — and with a new Afterword on the aftermath of the bust, Dot.con is a panoramic and stirring account of human greed and gullibility. Only read this book if you don’t want a story and can digest dry facts. It provides quite a bit of information but it really doesn’t tell a narrative. Also, some of the facts I’d disagree with but if you weren’t around during the dot com era this provides context. Look at it this way—this is raw data you’re putting into your subconscious and maybe in 3 years you’ll see something that reminds of something in this book.

- Bull!: A History of the Boom and Bust, 1982-2004 – In 1982, the Dow hovered below 1000. Then, the market rose and rapidly gained speed until it peaked above 11,000. This inside look at that 17-year cycle of growth, built upon interviews and unparalleled access to the most important analysts, market observers, and fund managers who eagerly tell the tales of excesses, presents the period with a historical perspective and explains what really happened and why.

- The Prince of Silicon Valley: Frank Quattrone and the Dot-Com Bubble – from the back streets of South Philadelphia to the peak of finance as the highest paid banker on Wall Street. From Cisco to Netscape to Amazon, Frank Quattrone took some of the biggest names in technology public. During the bubble years of 1999 and 2000, his California-based technology banking group led the most hot initial public offerings, which lifted the entire stock market to record heights. But after the bubble burst, the hot stocks cooled and ordinary investors lost billions.

- Contagious: Why Things Catch On – This is a dry type of book to read but what it does is provide a wide view of why things make it and why other things don’t. It’s one of the few books that provides a broad set of reasons– there are individual books for each one of the concepts discussed that do a better job.

- Extraordinary Popular Delusions and the Madness of Crowds – Extraordinary Popular Delusions and the Madness of Crowds is the original guide to behavioural psychology – and how manias, follies and superstitions begin, spread and (eventually) pass.